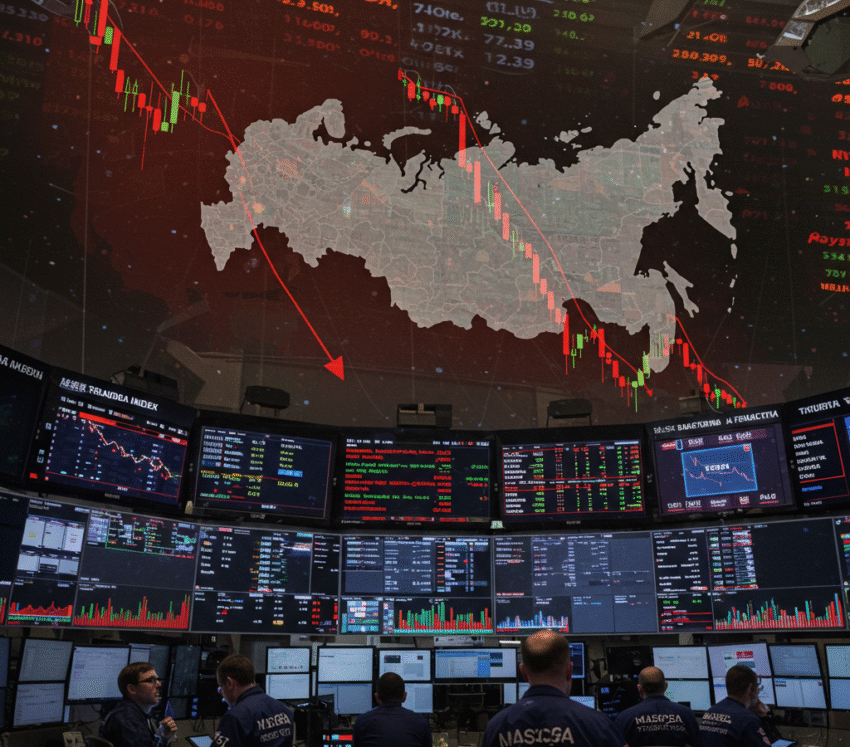

Russia’s Stock Market Hits Pause: What You Need to Know

Ever feel like the stock market is a rollercoaster that just won’t stop? Some days you’re climbing to new heights, and others… well, you’re just sitting still, unsure if you’re going up or down. That was the case recently with Russia’s stock market. Let’s take a closer look at what happened, why it matters, and what it could mean for investors going forward.

So, What Happened?

On a recent trading day, the Russian stock market, measured by the MOEX Russia Index, ended pretty much where it started—barely budging throughout the session. It closed the day essentially flat, slipping just a tiny bit by 0.06%. That might not sound like a big deal, but in the fast-moving financial world, even small shifts can carry deeper signals.

Why did this happen? Well, a few key sectors underperformed, dragging the index down, while others remained afloat. It was almost a tug of war between losing and gaining stocks, and in the end, neither side really won.

Breaking Down the Market Movement

Let’s dive into the nitty-gritty for a second. The MOEX index is made up of various companies from different corners of the Russian economy. On this quiet day, the market saw a mixed bag—some stocks gained ground, while others slipped.

Here’s a simple breakdown of how things looked:

| Top Gainers | % Gain | Top Losers | % Loss |

|---|---|---|---|

| PIK Group | +3.87% | LSR Group | -3.13% |

| IDGC of Center | +2.99% | Verkhnekamsk Potash Co | -2.43% |

| Moscow Exchange | +2.61% | RusHydro | -2.13% |

Looking at the table, it’s pretty clear that real estate and utilities were the sectors showing opposite trends—some rising sharply, others falling fast. Kinda like a seesaw, isn’t it?

What’s Causing These Up-and-Down Swings?

Markets don’t move without a reason. Often, it’s a mix of news headlines, investor sentiment, and economic data. In Russia’s case, several things may have played a role:

- Economic Uncertainty: As global economic conditions remain shaky, investors are hesitant to make big moves.

- Sector Rotation: Traders might be shifting their money from one sector to another. That can cause some stocks to fall and others to rise.

- Earnings Reports: Some of these companies may have released fresh financial results, influencing their stock prices.

All of these factors can influence investor choices, leading to uneven performance across the board. Think of it like a buffet—some dishes (or stocks) are everyone’s favorite today, while others stay untouched until interest shifts again.

How Did the Ruble React?

Currency plays a huge role in market performance, especially for countries tied closely to energy and exports—like Russia. On the same day the stock market took a breather, the Russian ruble stayed flat against the U.S. dollar. With stable currency movement, investors didn’t have much reason to panic or jump ship.

Investor Sentiment: Cautiously Neutral

When the market doesn’t swing much in either direction, it often reflects a wait-and-see attitude among investors. It’s a bit like checking the weather before going on a hike—it’s cloudy, and you’re not sure if it’s going to rain or clear up. So, you stay put and observe.

That could be exactly what’s happening here. With so many global uncertainties—rising interest rates, inflation fears, geopolitical tensions—many investors may be holding off on big decisions.

What Does This Mean for You?

Now, you might be wondering: “Okay, but how does this affect me?” Great question!

Whether you’re an active trader or someone just curious about worldwide financial trends, here are a few key takeaways:

- Stability in volatility: A flat market isn’t a bad sign—it often means a period of balance. But it can also be the calm before a storm.

- Watch the sectors: If you’re investing in Russian stocks or emerging markets, pay attention to how different sectors perform. Real estate and utilities seem to be areas to watch.

- Keep an eye on the ruble: A stable currency supports investor confidence. Major swings, however, can ripple through stock prices.

Final Thoughts: A Pause, Not a Stop

Markets are always in motion—even on days when they appear to stand still. Russia’s flat trading session signals that investors are taking a moment to catch their breath, weigh the risks, and consider the next steps. And sometimes, that’s not a bad thing.

Think of it like driving through fog—you slow down, stay alert, and wait for the road to become clearer. The same philosophy holds true in investing. Caution isn’t weakness; it’s smart decision-making.

Looking Ahead

Will the Russian stock market pick up momentum in the coming days? It’s hard to say for sure. But by understanding the market’s behavior—sector-by-sector—you’ll be in a better position to read the signs and make informed choices.

So next time you see the market “unchanged,” take a closer look. Hidden behind the stillness might be the early signs of change—just waiting to unfold.

Stay Curious, Stay Informed

Want to keep up with global financial trends without all the jargon? Bookmark this blog, and we’ll keep breaking down what’s happening in the market in simple terms—so you can stay informed, empowered, and always one step ahead.

Until next time, happy investing! Or, at the very least, smart observing.