Thailand Bets on Electric Vehicles, but China’s EV Battle Could Change the Game

Thailand has big dreams when it comes to electric vehicles (EVs). The country is working hard to become Southeast Asia’s main hub for EV production. But there’s a twist in the plot—China’s fierce EV price war is shaking things up, and Thailand’s plan isn’t as smooth as it seemed.

What’s Driving Thailand’s EV Ambition?

Let’s start with the basics. Thailand is known for being a major car manufacturing center in Southeast Asia. Big names like Toyota, Isuzu, and Honda already produce vehicles there. Now, Thailand wants to shift gears toward making more eco-friendly cars—electric vehicles.

To support this move, the Thai government came up with a strong set of incentives. These include tax breaks and subsidies to attract companies to build EVs in the country. Their big goal? To have 30% of vehicles produced in Thailand be electric by 2030.

Chinese EV Companies Enter the Scene

China is currently the world’s largest EV market—and it’s not even close. Buyers have tons of choices there, thanks to dozens of carmakers competing with each other. This competition has turned into a price war, with companies slashing prices to grab market share.

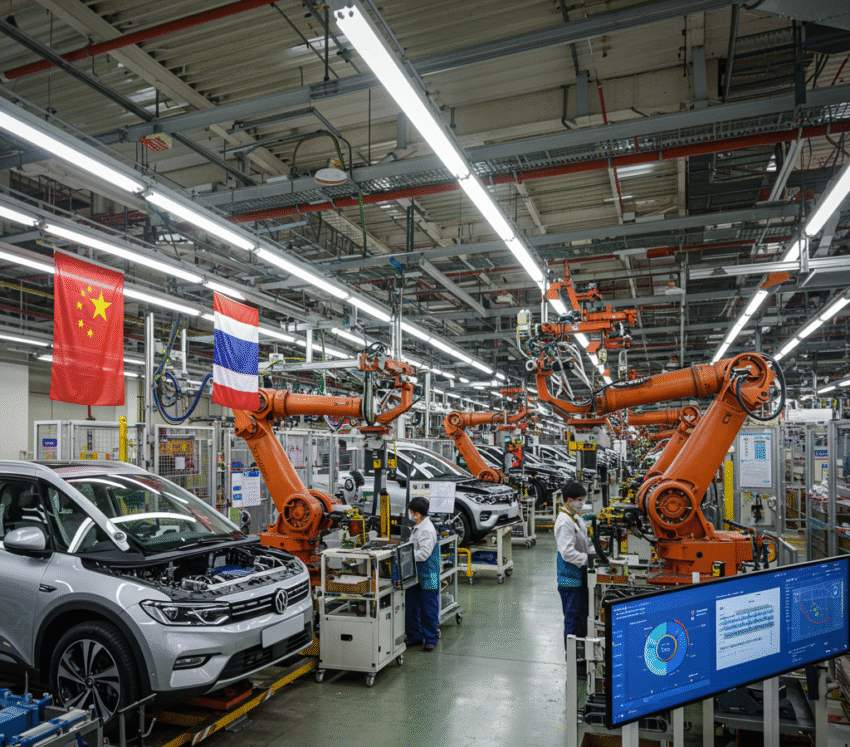

Now, many of these Chinese EV manufacturers are expanding into Thailand. Brands like BYD, Neta, and Great Wall Motor (or GWM) are already there, setting up local factories and signing deals with local partners.

Check out the table below to see who’s doing what in Thailand:

| Company | Investment in Thailand | Planned Production | Estimated Timeline |

|---|---|---|---|

| BYD | $491 million | EV production plant | Starts in 2024 |

| Neta (Hozon Auto) | $183 million | Factory with Bangchan General Assembly Co. | Launch in 2024 |

| Great Wall Motor (GWM) | Not disclosed | EV and hybrid production | Ongoing since 2021 |

The Catch? China’s EV Price War

Here’s where things get tricky. Back in China, EV brands are engaged in an all-out pricing fight. For example, BYD recently launched a compact EV for under $10,000. That’s incredibly cheap, even for an electric car.

As a result, these low-priced imports are now making their way into international markets—including Thailand. So even though Chinese companies are building local factories in Thailand, they’re still shipping in cheaper EVs from China.

This is a headache for Thailand. Why? Because their local production plans could get undercut by these cheaper imports. If buyers can get a Chinese-made EV for less, why wait for a locally built one that might cost more?

Thailand’s Government Feels the Heat

Thailand’s Board of Investment (BOI) hoped that carmakers would bring both jobs and technology by setting up factories. But the rise in imports from China risks slowing that down. Officials are now reviewing their policies to see if tougher rules are needed to protect local manufacturing.

At the same time, they don’t want to scare away Chinese automakers with too many restrictions. It’s a delicate balancing act—promote local production without hurting relationships with key investors.

Is Local Manufacturing Still Worth It?

If you’re wondering whether it still makes sense to build EVs in Thailand, the answer isn’t so simple. Making EVs locally helps the country create jobs, grow technical know-how, and reduce import dependency. But it’s tough to compete with the rock-bottom prices coming from China’s factories, where massive scale keeps costs low.

Companies like BYD and Neta are still betting on Thailand. They’re hopeful that the market will keep growing and that building cars locally can offer long-term benefits, like avoiding tariffs or winning customer trust by being “made in Thailand.”

What About Consumers?

Buyers in Thailand are already showing strong interest in EVs. In fact, China-made EVs make up over half of all electric cars sold in Thailand in Q1 of 2024. That’s impressive—and a clear sign of demand, especially for affordable models.

But how do buyers feel about locally made versus imported? That depends. Some may prefer cheaper imported cars today, while others may choose locally assembled EVs if after-sales service, parts availability, or government incentives improve.

Looking Ahead: What’s Next for Thailand’s EV Industry?

Thailand sits at a crossroad. On one side, the country has a solid vision and is attracting major EV investments. On the other, the Chinese price war could derail progress by flooding the market with cheaper imports.

So, what’s the way forward?

- Re-evaluate policies: Thailand may need to tweak its subsidy programs to better support factories over importers.

- Encourage innovation: Investing in local battery technology or EV parts production can give Thailand a competitive edge.

- Educate buyers: Helping consumers understand the value of locally produced EVs could create lasting brand loyalty.

Final Thoughts

Thailand’s push into the electric vehicle world is full of promise—but not without challenges. With Chinese automakers dominating the global EV scene and shipping in low-cost vehicles, countries like Thailand must think on their feet.

Will Thailand become Southeast Asia’s top EV maker? Or will imports take over? That story is still unfolding. One thing’s for sure: the race to lead the EV future in Asia is heating up fast.

Are you curious about electric cars or planning to buy one soon? Keep an eye on Thailand—it might just become the next big EV hotspot worth watching.

Keywords:

Thailand EV production, Chinese electric vehicles in Asia, BYD Thailand factory, Southeast Asia EV hub, EV price war China, local EV manufacturing Thailand, Thailand government EV incentives