AMC Networks Raises $400 Million: What This Means for Investors and Viewers

AMC Networks, the media company behind popular shows like The Walking Dead and Mad Men, just made a big financial move. They’re raising $400 million by issuing senior secured notes. If you’re scratching your head wondering what that means, don’t worry—we’re here to break it down in easy-to-understand terms.

What’s Happening With AMC Networks?

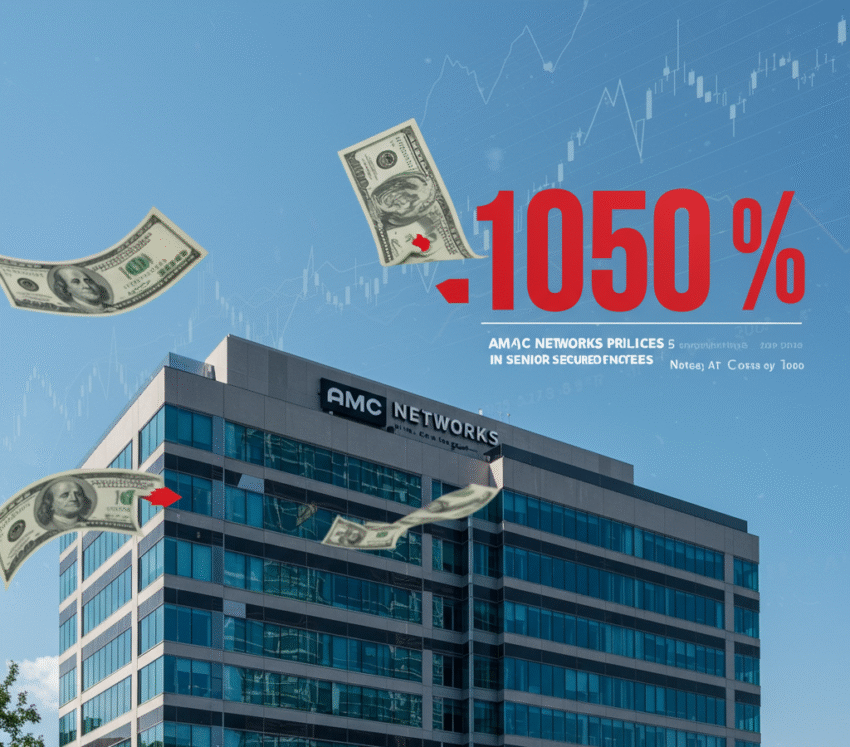

On May 22, 2024, AMC Networks priced a new offering: $400 million worth of senior secured notes, which are set to mature in 2029. These notes come with a hefty interest rate of 10.50%. That’s the kind of percentage that gets attention—not just from investors, but also from folks curious about what AMC is planning next.

So, why would a media company take on this kind of debt? Let’s dig in.

First Things First: What Are Senior Secured Notes?

Imagine lending money to a friend. If you’re worried they might not pay you back, you might ask for some kind of collateral—maybe their gaming console or car—to ensure you don’t walk away empty-handed.

Well, that’s sort of how senior secured notes work. These are bonds that must be paid back before other debts if AMC runs into financial trouble. And because they’re “secured,” they are backed by AMC’s assets—things like its content library, brand, or even broadcasting rights.

Simply put, they’re a safer bet for investors—and that also allows AMC to borrow money more easily.

Here’s a quick look at the information AMC shared:

| Details | Information |

|---|---|

| Offering Amount | $400 million |

| Type | Senior Secured Notes |

| Interest Rate | 10.50% |

| Maturity Date | June 15, 2029 |

| Expected Closing | May 30, 2024 |

Why Is AMC Doing This Now?

Let’s be real—2023 and 2024 haven’t been easy for traditional media companies. Streaming wars, shifting viewing habits, and economic pressures have forced networks to rethink their strategies.

AMC Networks is trying to manage debt that comes due in 2025. Specifically, they want to use the new funds to repay some or all of their senior secured term loan due 2025. Think of it like refinancing a mortgage: getting a new loan to pay off an old one, possibly buying more time and reducing pressure, even if the interest rate is a bit higher.

It’s a balancing act—and shows that AMC is actively managing its finances rather than waiting to be pushed around by market forces.

What This Means for Investors

If you’re an existing investor—or thinking about becoming one—this kind of move might leave you with mixed feelings. On one hand, raising money helps AMC stabilize and fund its ongoing operations, maybe even invest in new content. On the other hand, a 10.5% interest rate signals that investors see some risk in lending to AMC.

Still, the bond market sees high-rate bonds like this as an opportunity. Higher interest usually means higher return—if the company stays afloat. That’s the gamble.

Here are a few takeaways for investors:

- Debt management: AMC is actively taking steps to handle its upcoming obligations.

- Signal of need: Selling such high-interest notes shows the company needs cash—and hasn’t found cheaper options.

- Market confidence test: Successfully closing the deal would mean investors still have confidence in AMC’s business model.

What’s in It for Viewers?

You might be wondering: “Okay, but how does this affect me—the viewer who just wants the next season of Interview with the Vampire?”

The answer is, quite a bit. The more stable AMC’s finances are, the better they can invest in the content you love. This $400 million could help fund future productions, expand streaming platforms like AMC+, and keep your favorite shows on air.

Plus, companies with financial breathing room are in a better position to try new things—whether that’s new storylines, genres, or exclusive releases for subscribers.

The Bigger Picture: Media Industry Trends

What AMC is doing isn’t unusual. Many media giants—like Warner Bros. Discovery and Paramount Global—have taken on new debt or sold assets to stay competitive in today’s cutthroat media landscape.

As more people ditch cable for streaming, companies need to invest heavily in digital platforms without alienating their traditional viewer base. It’s a tricky balance, and financial strategies like debt issuance help navigate those uncertain waters.

Conclusion: A Bold Move with Calculated Risk

AMC Networks isn’t panicking—they’re planning. This $400 million offering is a clear signal that the company wants to pay off older debt and gear up for the future, even if it means taking on higher interest rates in the short term.

For investors, it’s worth watching closely. Will AMC use this cash wisely? Will it spark a new era of thrilling dramas and compelling documentaries?

For viewers, it might just mean your favorite shows aren’t going anywhere—and you might see even more fresh, original content headed to your screen soon.

Final Thoughts

At the end of the day, media companies like AMC have to play both offensive and defensive. With smart financial planning and strategic storytelling, they just might stay ahead of the changing curve. It’s not just about lights, camera, action—it’s also about debt, interest, and investment.

So next time you watch an AMC show, remember: behind every storyline is a business strategy that made it possible.

SEO Keywords Used Naturally:

- AMC Networks financial news

- AMC Networks debt offering

- AMC senior secured notes

- Media company investment strategy

- 2024 media industry trends

- Investor news AMC Networks

- Streaming content investment

- Debt refinancing in media

Stay tuned as we track how AMC Networks positions itself in 2024 and beyond. Want more breakdowns like this? Subscribe to our newsletter or leave a comment below!