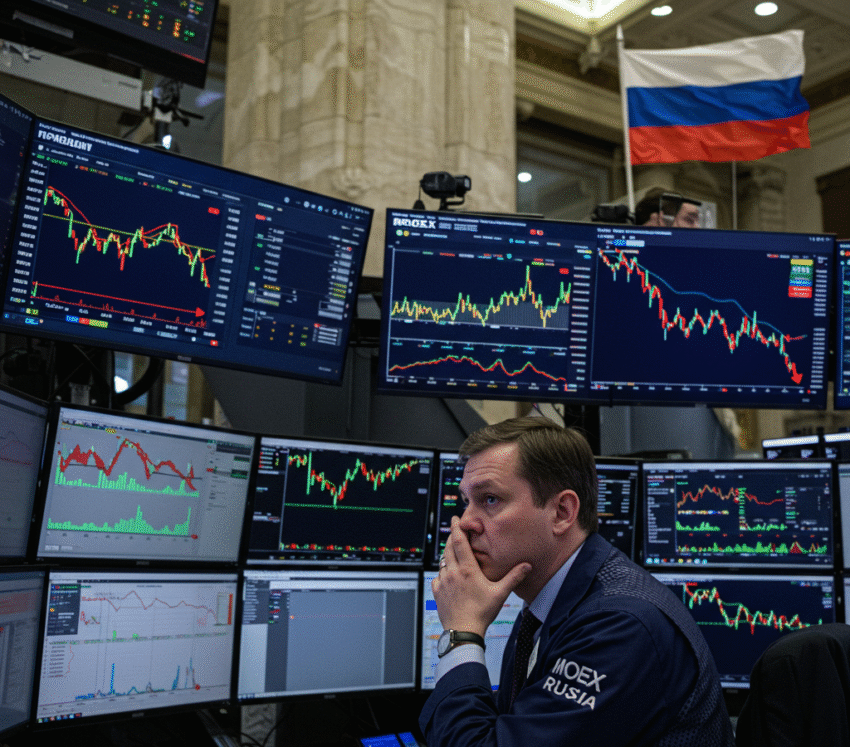

Russian Stocks Finish Lower as Market Faces Mixed Signals

Ever feel like the stock market has a mind of its own? One day it’s soaring, the next it takes a dive — sometimes for reasons that aren’t so clear. That’s pretty much what investors in Russia saw recently as the country’s leading stock index slipped slightly, with some sectors doing well while others pulled back. If you’re keeping an eye on global markets, here’s what you need to know about the latest from the Russian exchange and what it might mean going forward.

How Did the Market Perform?

The MOEX Russia Index, which tracks the performance of the largest and most liquid Russian companies, closed lower on Thursday. Although the decline was small, it was still enough to nudge investor confidence. Some stocks managed to climb higher, but overall, the market felt the pressure from mixed economic signals and cautious investor sentiment.

The index dipped just 0.01% by the end of the trading session — not a huge change, but enough to show the market is treading water as it waits for a clearer direction.

Top Performers of the Day

Despite the market’s overall slight drop, a few companies posted solid gains. Some sectors — especially food, beverages, and forestry — managed to stay in positive territory.

Here are the top three performers on the MOEX Index by the day’s close:

| Company | Sector | % Change |

|---|---|---|

| Ros Agro PLC | Food & Agriculture | +3.13% |

| ALROSA | Mining (Diamonds) | +2.05% |

| Yandex NV | Tech (Search & AI) | +1.59% |

For example, Ros Agro PLC saw a solid boost of over 3% as demand for food products continued to show resilience. ALROSA, the Russian diamond giant, also posted healthy gains, possibly due to higher global interest in precious stones and jewelry. Meanwhile, internet giant Yandex rose as well, reflecting the growing appetite for technology and digital services.

Biggest Losers

On the flip side, a few companies weighed heavily on the index, wiping out gains made by others. The worst performers were mostly from the energy and infrastructure sectors.

| Company | Sector | % Change |

|---|---|---|

| Inter RAO | Energy | -1.95% |

| Globaltruck Management | Transportation | -1.80% |

| TCS Group Holding PLC | Banking & Finance | -1.50% |

Power company Inter RAO led the losses, falling nearly 2%. This drop may have been triggered by ongoing uncertainties around energy pricing or regional supply issues. Trucking firm Globaltruck also slid, likely due to rising fuel costs and inflation pressures pinching transport margins. Financial firm TCS Group wasn’t spared either, slipping by 1.5%.

Why Such Mixed Results?

It’s natural to wonder — why are some companies thriving while others are floundering? A big part of the answer lies in Russia’s current economic environment. Let’s take a step back and look at a few key factors that could be influencing the stock market:

- Global Commodity Prices: Russia’s economy leans heavily on oil, gas, and metals. When prices dip, so do energy stocks.

- Geopolitical Tensions: Continued sanctions and international pressure can make foreign investors nervous and reduce market activity.

- Inflation Concerns: Rising costs of goods and services are impacting consumer demand and corporate profit margins.

- Currency Volatility: The ruble’s performance can affect investor confidence — a weaker ruble can hurt importers while helping exporters.

The combination of these factors is like a seesaw. Some companies — like exporters and food producers — benefit from global trends, while others — such as transportation and energy companies — may feel the pinch.

What About the Ruble?

Currency always plays a role in stock market performance, especially in economies like Russia’s. On Thursday, the ruble fell against the euro and held steady against the U.S. dollar. Here’s a quick glance:

| Currency | Move Against Ruble |

|---|---|

| US Dollar (USD) | Unchanged |

| Euro (EUR) | +0.15% (Ruble dipped) |

Fluctuations in currency impact international trade and influence investor decisions. For example, a weaker ruble makes Russian exports cheaper globally, helping exporters like ALROSA. But it also raises the cost of imports, which can squeeze companies dependent on foreign goods or equipment.

Investor Sentiment: Is the Market Waiting for a Signal?

One thing seems clear — investors are feeling cautious. Despite some positive earnings and industry-specific optimism, there’s a general sense of “wait and see.” Many are holding back from large investments until there’s more clarity on interest rates, inflation trends, and potential government policy shifts.

You might relate. Imagine standing at a pedestrian crossing where the signal seems stuck — do you take the risk and move forward, or wait until you’re sure it’s safe? That’s the mindset many investors have right now.

Trading Volume and Market Breadth

Another indicator worth watching is trading volume. A relatively flat market coupled with lower trading activity often reflects indecision. When investors feel confident, they trade more. But when uncertainty looms, they wait it out.

Volume on Thursday suggested just that — a day of cautious trading with few big moves. That further reinforces the “on hold” mood across the MOEX.

Should You Be Paying Attention?

Absolutely. Even if you’re not investing in Russian stocks, market trends in large economies like Russia can have ripple effects. For example, changes in commodity prices affect global inflation. And shifts in energy trading can impact fuel costs around the world.

It’s much like weather patterns — a storm in one part of the globe can influence conditions elsewhere. So, keeping an eye on the Russian market gives you a piece of the larger economic puzzle.

Final Thoughts

The Russian stock market is currently moving sideways, showing both resilience and signs of caution. While some sectors — like agriculture and tech — are seeing growth, others are being dragged down by external challenges. The MOEX sliding just slightly shows investors aren’t panicking, but they aren’t jumping in either.

As always, whether you’re a seasoned investor or simply curious about global economics, understanding these shifts helps you make smarter decisions — financially and otherwise. And who knows? The next big opportunity might just come from keeping an eye on markets like this one.

Stay tuned, stay informed, and remember: the stock market may be unpredictable, but the more you learn, the less it surprises you.