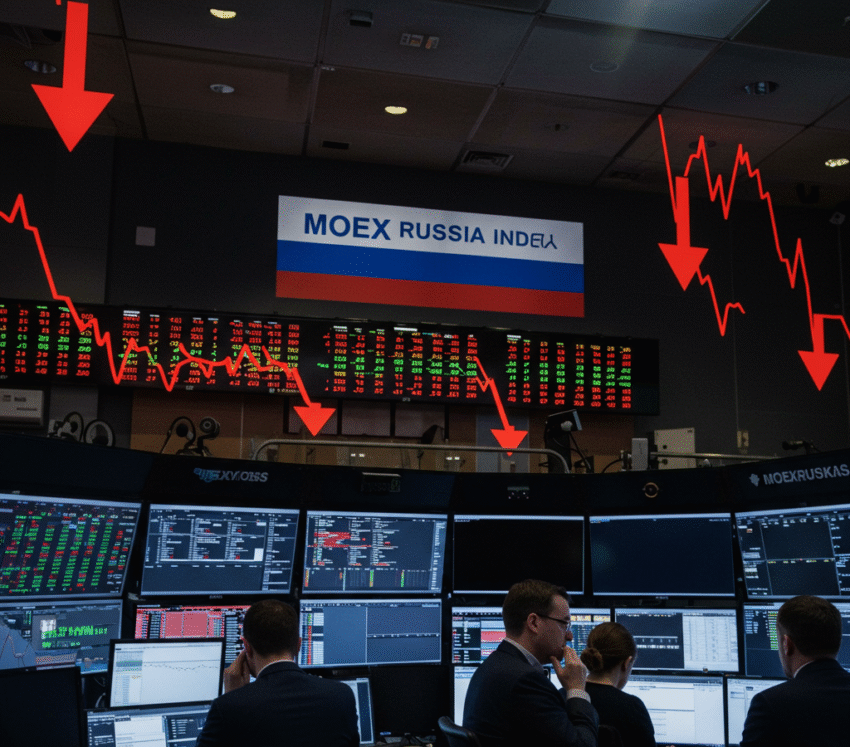

Russia’s Stock Market Hits Pause: What Happened and Why It Matters

Ever feel like you’re watching your favorite movie and it suddenly hits the pause button right at the climax? That’s pretty much what happened in Russia’s stock market this week. After a series of ups and downs, Russian stocks ended the trading day flat. But don’t let the word “flat” fool you—there’s more going on beneath the surface.

Let’s Break It Down: What Actually Happened?

On Monday, the MOEX Russia Index—a benchmark that tracks the top Russian companies—closed slightly lower. It moved just a notch, dropping by 0.02%. This might seem like a tiny change, but it’s enough to raise some eyebrows among investors and market watchers. Being flat or barely moving means the market is unsure. It’s like standing at a crossroads and not knowing which way to go.

Key Takeaway:

- MOEX Russia Index: Fell slightly by 0.02%, ending at 3,281.52.

- Uncertainty looms: Many investors are playing the waiting game.

Winners and Losers: Which Stocks Moved the Most?

Even when the overall market doesn’t do much, individual stocks still make moves. Here’s a quick snapshot of the day’s biggest gainers and losers:

| Company | Industry | Stock Movement |

|---|---|---|

| Tinkoff Bank (TCSG) | Banking & Finance | +2.93% |

| Polymetal International | Mining & Metals | +1.30% |

| Yandex | Technology | -2.86% |

| VTB Bank | Banking | -1.34% |

As you can see, Tinkoff Bank had a great day. Maybe people are feeling positive about digital banking. On the flip side, Yandex, often called “Russia’s Google,” took a hit. That could be due to global tech market trends or company-specific news.

Why Are Russian Stocks So Temperamental?

The fluctuations in the Russian stock market can be compared to someone walking a tightrope during windy weather. One moment the skies are clear, and the next—you’re battling headwinds. Several factors are fueling this instability:

- Global economic uncertainty: With inflation, high interest rates, and geopolitical tensions, investors are cautious.

- Oil prices: Being a key player in global energy, Russia’s financial markets often move alongside oil prices.

- Investor sentiment: People are more careful about risk these days, especially in emerging markets like Russia.

An Analogy That Might Help

Imagine you’re at a party. Some folks are mingling, others are standing near the exit… just in case. That’s where the Russian stock market is right now—halfway into the room but still nervous about sticking around. Investors aren’t running out the door, but they’re not fully confident either.

Currency Check: What’s the Ruble Doing?

While the stock market tiptoed around, Russia’s currency—the ruble—was also making moves. It fell slightly against major foreign currencies. Here’s a quick look:

| Currency Pair | Change |

|---|---|

| USD/RUB | +0.16% (75.07) |

| EUR/RUB | +0.28% (80.68) |

What does this mean for everyday people? A weaker ruble can make imported goods more expensive and increase the cost of traveling abroad. In other words, people might start thinking twice before ordering that pair of sneakers from overseas or booking a trip to Paris.

How Does This Affect Investors?

If you’re new to investing or just curious, you might be wondering, “Why should I care?” That’s a fair question. Here’s why it matters:

- Market performance shows confidence (or lack thereof): A flat market often signals investors are waiting for more clarity before making bigger moves.

- If you invest globally: Even if you don’t own Russian stocks, what happens in one market can impact others, especially in an interconnected world.

- Emerging markets are sensitive: News, politics, and policy changes have an immediate impact, making them both risky and potentially rewarding.

So, What Comes Next?

Honestly, predicting the market is kind of like predicting the weather. You can look at trends, study the forecasts, and cross your fingers. Here are a few things investors will be watching in the coming days:

- Possible sanctions or political shifts that could affect Russia’s economy

- Upcoming announcements from major Russian companies

- Global oil prices and their impact on Russia’s energy sector

- Movement in global markets, especially in Europe and Asia

Final Thoughts: Stay Calm and Stay Informed

Markets go up and down—it’s just what they do. What’s important is understanding why they move and what that means for you. If you’re an investor, now might be a good time to rethink your strategy or just review your portfolio. If you’re just curious, congratulations! You’ve taken the first step toward being more financially aware.

Think of investing like gardening. Some days it rains, some days it’s sunny. What matters is planting the right seeds and being patient as they grow. Keep watching, keep learning—and don’t panic over every small dip or rise.

Have Questions?

Let us know in the comments! Do you follow markets in emerging economies like Russia? What do you think about the current twists and turns in global investing? We’d love to hear your thoughts.